I have been on the hunt for worldwide travel insurance ever since I became a digital nomad in 2014, the year when I left Germany for good to travel the world and live my dream of working entirely online from my laptop.

Never in my wildest dreams would I have imagined that I would actually build this dream. And still live it now, having a home base in beautiful Australia, and the freedom to travel and explore the world with the business and lifestyle I built around it.

Ultimate freedom. Something I always wanted and if you read this article, you have probably been eyeing off traveling long-term too.

Heck, it’s the best thing ever!

Table of Contents

- Important Things To Do Before You Take Off

- Evaluate Your Travel Plans

- The Best International Travel Insurance: SafetyWing

- What Is SafetyWing Travel Insurance?

- Who Is SafetyWing Insurance For?

- Get To Know SafetyWing Insurance Coverage

- Questions To Ask About Your Nomad Insurance (Before Buying It)

- SafetyWing Insurance Coverage Inclusions

- What Is Excluded With SafetyWing?

- What Does SafetyWing Travel Medical Insurance Cost?

- Why Is SafetyWing So Affordable & Can You Trust Them?

- The SafetyWing Claim Process

- Get A Quote With SafetyWing

Important Things To Do Before You Take Off

Before you dive into the digital nomad lifestyle and commence your nomad journey, there are a few things that you should organize.

Among the most important things are:

- Figure out how to find and connect to WiFi anywhere you travel. Because you want to order Uber, find directions and let your family know that you are save, right? Read my article finding WiFi worldwide this here.

- Find a remote job, so you can make an income on the road and use currency exchange rates to your advantage to build an amazing lifestyle. Read my article on how to find a remote job here.

- Organize your money affairs and figure out how to get money out abroad with no hidden fees. Check out TransferWise, the best borderless bank account you will ever have!

- Lastly, travel medical insurance, which is often either overlooked or over-complicated. It took me forever to find comprehensive, nomad-friendly coverage, so I could travel long-term with peace of mind that I don’t have to fork out hundreds or thousands of dollars if something unexpected happens. Motorbike accidents, lost luggage, food poisoning, it’s all too common.

Evaluate Your Travel Plans

Do you know where you will be traveling to already? How long will you be gone for?

If your answer is ‘no’ and ‘nope’, it might be hard to find a travel insurance where you can get coverage for an unknown destination. Also, if you just want to take off with no end date in mind, you might have noticed that most insurances will need you to specify a date in the future, when you will return to your home country.

Usually, you will also pay the whole policy amount upfront and when you go over the set return date, you may find yourself uninsured. Let that not happen to you!

Over the years, I’ve had to return twice to Germany to renew my travel insurance, as I couldn’t do it on the road, they wanted me to come back and take it out while in my home country. Damn!

I then found myself uninsured while visiting my home country, as I am not registered there anymore and don’t just get health insurance handed to me like that.

As I researched more and more, I found an expat insurance that would take me on where I could renew every year, even while I was on the road. However, the price was insane and a whole year of upfront payment hurt my pockets. No monthly payments here. I additionally had to always specify the countries I was going to travel to next. Talk about flexibility or changing plans!

The Best International Travel Insurance: SafetyWing

What Is SafetyWing Travel Insurance?

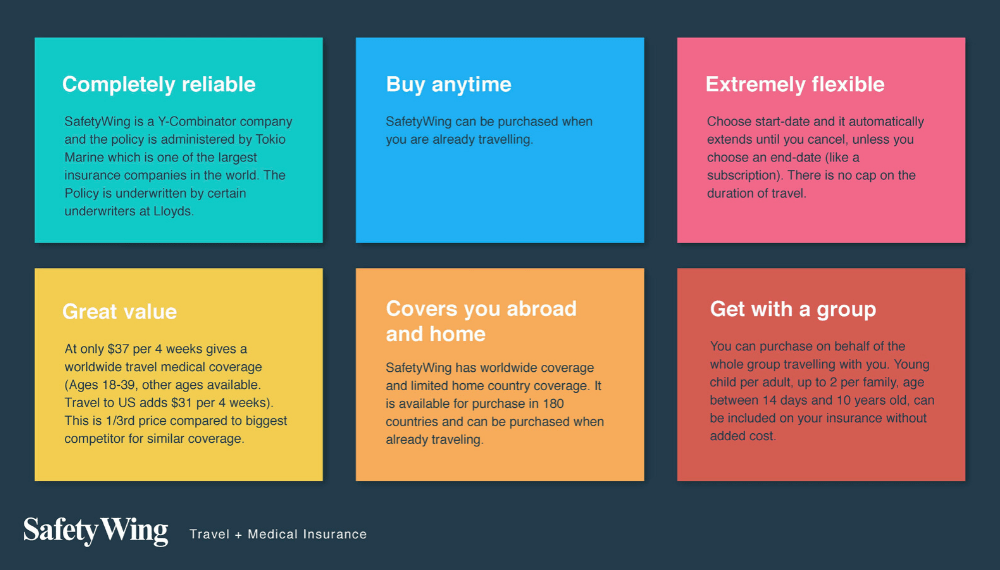

And so I finally found the ideal nomad insurance, the new kid on the block called SafetyWing, offering an insurance policy that gives you ultimate freedom and flexibility when it comes to international heath insurance.

Who Is SafetyWing Insurance For?

These guys realized that location independent people and wandering nomads fall between the cracks and there is simply no proper solution to get insurance long-term.

So they started building a safety net for online freelancers, entrepreneurs, remote companies and anyone who sets off to travel for a while with no return date in mind. We are millennials after all and it’s not so uncommon anymore!

Currently, SafetyWing offers a travel and medical insurance with future plans to build a complete social safety net that works across borders. What a mission!

You can read all about their big vision and plans here.

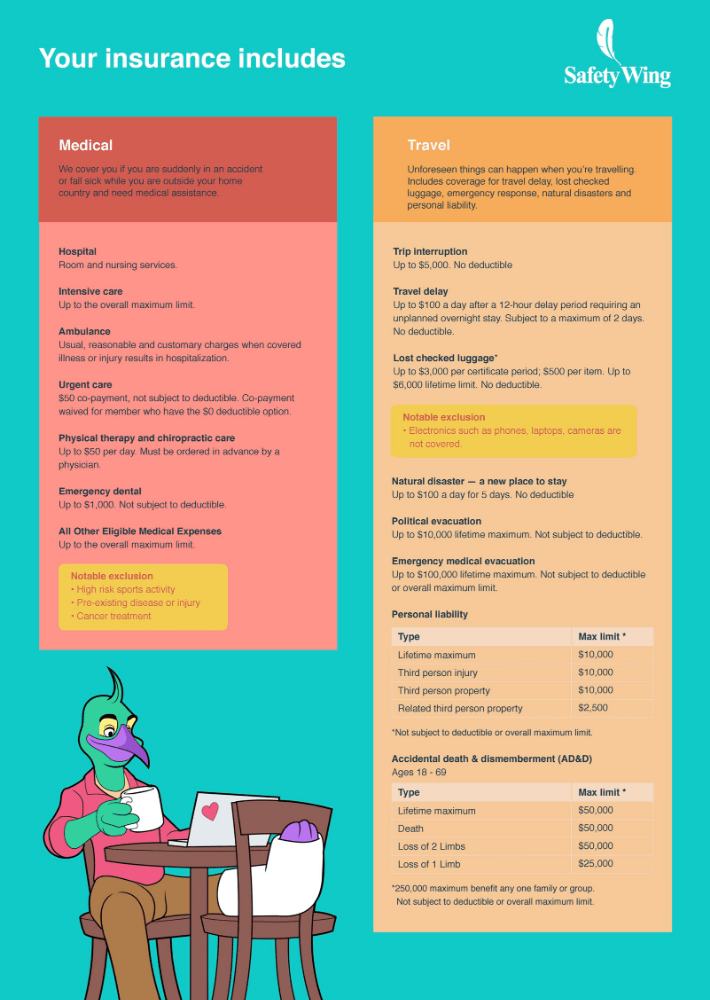

Also included is coverage for travel delays, trip interruption, lost checked luggage, natural disaster, political and emergency medical evacuation.

In this article, I am aiming to provide detailed answers and information to understand SafetyWing insurance for long-term travelers and digital nomads. Please note that changes to insurance policies can happen and it is your responsibility to verify and use the information provided at your own discretion. I am an affiliate for SafetyWing insurance, as well as a consultant.

Get To Know SafetyWing Insurance Coverage

#1 Available In 180 Countries

SafetyWing gives you worldwide travel medical coverage and is available for purchase in 180 countries.

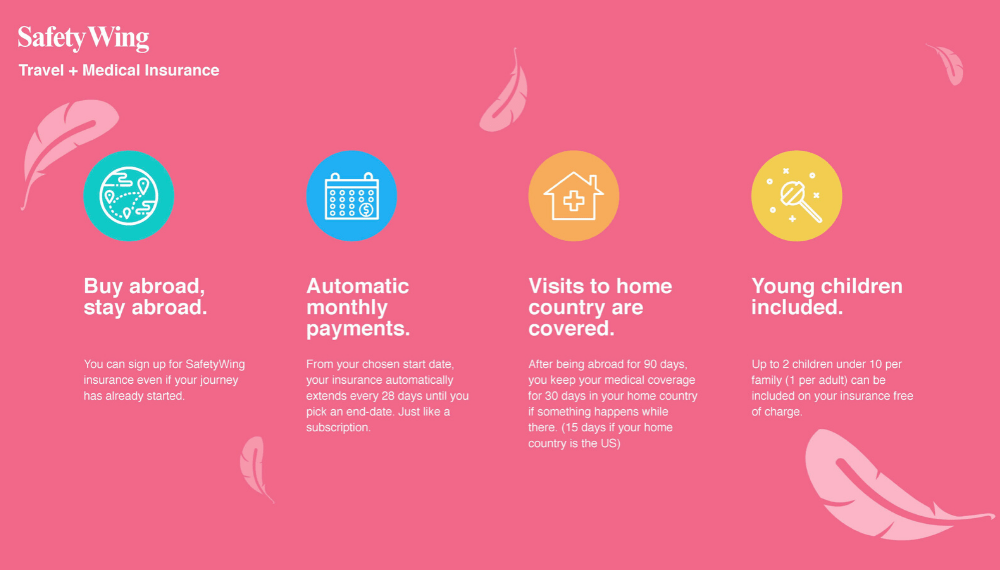

You can also buy SafetyWing insurance when you are already traveling, no need to physically be in your home country when you start your coverage. You simply put a postal address in your home country, which can be your parent’s house for example, and you are good to go!

#2 No Cap On Travel Duration

With SafetyWing, you get unlimited coverage with no cap on the duration of travel, which means this can actually become your ultimate long term health insurance.

This allows you to stay on the road for months or even years without ever finding yourself uninsured or having to fly back to your home country to renew or take out new insurance policies.

#3 Automatic Monthly Payments, No Big Upfront Costs

Working on an automatic monthly subscription model, you don’t need to make big upfront payments to cover your travel medical insurance that covers you in the sudden event of sickness or accident and you’re in need of medical assistance.

Every 28 days, your digital nomad insurance extents automatically, until you pick an end-date. Just like Netflix but for travel insurance, pretty cool!

#4 Coverage When Traveling Back Home

As a nomad, you surely want to visit your family and friends back home at some stage, may it be Christmas, a special birthday or just because you haven’t seen them in a while.

With SafetyWing, you get 30 days medical coverage in your home country for every 90 days you use the insurance.

If you are from the US, you’ll get 15 days of home country coverage for every 90 days.

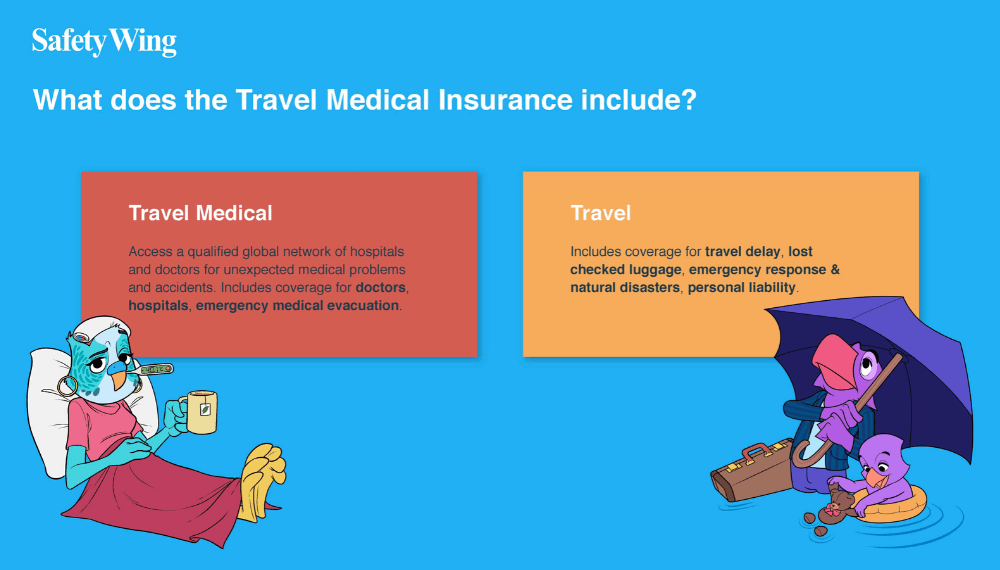

#5 Travel And Medical Coverage

In short, SafetyWing covers the following:

- Medical Insurance, covering you in the event of unexpected medical problems and accidents where you need to go to a doctor, hospital or need emergency medical evacuation.

- Travel Insurance, covering you in the event of travel delays, lost luggage, natural disasters and personal liability.

Sounds good in theory, right? Before you start signing up to any insurance policy, make sure you have read the fine print and if you have any additional questions about the nomad travel insurance, you need to ask them directly!

Luckily, SafetyWing has a chat window on their website where you can easily type in your question and get an answer from the team within a day, often they reply within a few hours.

Questions To Ask About Your Nomad Insurance (Before Buying It)

Here are a few questions you should find out about any travel insurance policy you are thinking of buying:

- Is there a deductible on claims? If so, what is it? The deductible is the out-of-pocket cost you need to pay for any medical treatments before your insurance kicks in. Understand, that insurance companies primarily cover large and catastrophic losses that would financially ruin you. A deductible gives the policyholder responsibility to share the cost in the event of an accident. If there is no deductible on an insurance policy, everybody would claim even the tiniest amount which would result in an increase of claims and therefore usually increases the overall cost of a policy, so it’s not necessarily a bad thing to have a deductible, you just need to know how much it is and have that amount saved up in your emergency fund.

- Does the insurance cover pre-existing medical conditions?

- Are you an adventure junkie? Well, you better make sure what sports and activities are covered. Can you go scuba diving, skydiving, Muay Thai boxing or paragliding without a worry?

- How is a claim being made? And how long will it take to be reimbursed? Note that most companies will limit the time for lodging a claim after the incident occurred. Also, if you had belongings stoles, you will need an official police report in most cases.

- Do you need your valuables like smartphone, laptop and cameras insured? This may increase policy costs.

Never Assume Anything

Additionally to asking these questions, I also encourage you to read negative SafetyWing travel insurance reviews. This will help you ask the right questions before you buy your policy and you will not become one of them!

I have been sick and needed to go to the hospital a few times over my years of traveling. One time, I stayed in a really shitty hostel in Chiang Mai and was greeted by bed bugs bites the next morning.

Through the heat, sweating, dirt and not taking care of my skin, the bed bug bites got infected and I needed to go to the hospital to get them treated properly. It was absolutely horrible and I was so grossed out by myself.

Record Everything

Luckily, I recorded everything, had the proper receipts and could make a claim within a few days to receive my money back. The process still took time to verify my claim and come through. Expect this to be a few weeks and have an emergency fund to pay for medical expenses upfront before you can get reimbursed.

Negative reviews of insurance providers are usually the result of people not reading the policy correctly BEFORE buying, assuming this or that was included and feeling entitled to get the money back into their pocket the next day.

Unfortunately, that’s not how it works. You will always need your receipts and if this involves lost or stolen items, make sure to get formal statements of local authorities to prove what has happened.

SafetyWing Insurance Coverage Inclusions

Below, I want to go into more detail what exactly is included with the SafetyWing nomad travel insurance.

Please note that the summary below doesn’t contain the full terms and conditions of the policy and is not tailored to any individual or specific needs. To view the full description of coverage, please follow this link.

SafetyWing covers you with travel and medical insurance up to a maximum of USD 250,000 and has a $250 deductible, which is fairly reasonable.

The key inclusions for SafetyWing long term travel insurance are:

Medical Insurance Coverage:

- Local ambulance and hospitalization

- Emergency room and urgent care centers

- Hospital room and nursing services

- Emergency dental treatment

- Injury or illness due to terrorism

- Prescription drugs for treatment of a covered injury

- Emergency medical evacuation up to $100,000 lifetime maximum

- SafetyWing covers a wide range of sports and activities, including scooter accidents, which are unfortunately very common when traveling Southeast Asia

Travel Insurance Coverage:

- Trip interruption

- Travel delay

- Lost checked luggage

- Natural disasters

- Political evacuation

- Personal liability

- Accidental death and dismemberment

What Is Excluded With SafetyWing?

#1 Routine Examinations & Country Exclusions

In a nutshell, you are not covered for routine and preventative medical examinations.

You are also not covered when traveling to Cuba, Iran or North Korea. You are also not covered for kidnapping that begins in Iraq, Afghanistan, Pakistan, Nigeria, Somalia or Venezuela.

#2 Electronic Devices

Unfortunately, SafetyWing doesn’t currently cover electronic items like laptops, cameras and phones, which are essential items for digital nomads and a loss of these can be detrimental.

That being said, I always make an effort to take great care of my electronics, lock them in hotel safes and make sure I don’t openly carry or show them in public. If you rely on your electronic devices to work and make an income, I highly recommend you have an emergency fund to cover a potential loss of those items.

#3 Pre-Existing Conditions

Pre-existing medical conditions, mental health disorders, pregnancy, any forms of cancer and obesity are not being covered.

For pre-existing conditions there is a little line in the policy providing limited coverage for an acute onset of a pre-existing condition, if treatment is obtained within 24 hours of onset.

#4 High-Risk Activities

If you are into high-risk activities, you should know that SafetyWing doesn’t cover professional sports or high-risk activities, such as:

- Base Jumping

- Boxing or Martial Arts

- Heli-Skiing

- Motorized Dirt Bikes

- Running with the Bulls

- Rugby

For the full list of included and excluded sports and activities, check the full policy description.

Note that terrorism and political evacuation excludes locations where the US Department of State has issued level 3 or 4 travel warnings.

What Does SafetyWing Travel Medical Insurance Cost?

SafetyWing starts at a very affordable USD37 per 4 weeks for global health insurance cover, this is for people between 18 and 39 years of age and excluding travel to the US.

If you want to travel to the US, the cost per 4 weeks insurance is USD68. The price is higher if you include the United States as the medical care cost is simply much higher there than in the rest of the world.

If you are older, these are the prices you will pay for your coverage:

- 40-49 years old: $60 without travel to the US or $111 including travel to the US

- 50-59 years old: $94 without travel to the US or $184 including travel to the US

- 60-69 years old: $128 without travel to the US or $251 including travel to the US

Get Your Free SafetyWing Insurance Quote:

And good news for families traveling with young children: SafetyWing includes one child between the age of 14 days and 10 years old per adult at no extra cost. Up to two children per family can be included on the insurance without added cost.

This is huge as family travel and home schooling on the road becomes more and more attractive.

If you have compared other travel insurances before, you might know that this is very affordable and about a third of what you’d expect to pay with other insurance providers for similar medical travel insurance coverage.

Why Is SafetyWing So Affordable & Can You Trust Them?

Well, first of all, you can buy SafetyWing nomad health insurance only online. This means there are no overheads or brokers that need to be paid commissions, so these savings can be passed on directly to the consumer, you!

Can you trust SafetyWing? As a Y-Combinator company, the policy that SafetyWing offers is administered by Tokio Marine, one of the largest insurance companies in the world and is underwritten by Lloyds.

The SafetyWing Claim Process

SafetyWing has a database of hospitals and doctors around the world, which you can find here.

If you decide to use one of the hospitals listed in the network, you can bill the company directly. This will save you from paying upfront and then having to wait for reimbursement. However, this is only an option if the doctor in the database has “direct bill” enabled.

When this is not always be available to you, you can freely choose whichever hospital or doctor you want to go to anywhere in the world, there are no limits.

Show your SafetyWing ID card to the medical staff at your chosen practice. They may not always know SafetyWing, but this way you can show proof that you have travel medical insurance to pay for your treatment.

Once you have made the payment yourself, be sure to only leave when once you collected all bills and invoices. The next step is to file a claim online as soon as you can.

You will have to log in to your SafetyWing account online and click “Make a claim” in the drop down menu. Here you can download the claim form, which you send along with your screenshots of your receipts to their email address. Once confirmed, the claim process should take less than 45 days before you’ll be reimbursed.

Get A Quote With SafetyWing

Is SafetyWing the best long term travel insurance? It may as well be!

With unlimited travel around the world, home country coverage for that next family visit as well as paying monthly instead of upfront, SafetyWing truly offers a lot for an excellent price of $37 for 4 weeks of coverage.

The only downside to me is that SafetyWing doesn’t insure electronic devices – for now, hopefully that will change in the future!

Please note, this post may contain affiliate links, which means that – at absolutely no cost to you – we earn a small commission on sales generated through this website. We only recommend sites we actually use and thank you for your support!